Digital Currency and The Coming New World Order

Seems like The Corona Pandemic Was Just In Time To Bring This In - (A little Too Convenient Maybe?)

Digital Currency, One World Religion, and the Coming of the New World Order

August 1, 2020/StevieRay Hansen/2 Comments

Featured Story

UP-Date: AntiChrist Will Make His Move SOON–Globalists Call for Cashless Society in Response to Coronavirus, Warning Physical Money Is Dirty…

“And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name.” This cryptic verse from the book of Revelation describes a future dystopian world where cash is no longer king, as it’s been replaced by the mark of the beast that’s right now being unveiled before our very eyes in response to the Wuhan coronavirus (CoVid-19).

Not long after Beijing started “quarantining” physical money all throughout China because it might be infected with the novel virus, the Federal Reserve here in the United States decided to do the same thing by “quarantining physical dollars that it repatriates from Asia before recirculating them in the U.S. financial system,” according to a Fed spokesperson.

While all money isn’t quite yet been fully and systematically removed from American circulation, we’re witnessing the precursors to this exact thing happening in the soon coming days as Wuhan coronavirus (CoVid-19) fear and panic continues to run its treacherous course.

The money quarantine decision comes as a “precautionary measure,” with the Fed indicating that said money will have to remain under mandatory lockdown for at least 10 days before recirculating. Specifics about how these paper dollars will be effectively sanitized before being reintroduced have not been disclosed by the Fed.

Listen below as Mike Adams, the Health Ranger, warns about how a new pandemic model predicts that upwards of 2.1 million people will die from the Wuhan coronavirus (CoVid-19) in the United States alone:

Coronavirus represents the “perfect storm” for unveiling the antichrist

Prompting this Fed decision was a recent announcement made by the World Health Organization (WHO), a division of the United Nations (UN), about how the Wuhan coronavirus (CoVid-19) can supposedly live on banknotes, potentially exacerbating community spread of the disease.

In order to reduce the risks involved with handling paper cash, the globalist entity added, citizens everywhere should try to use digital payments whenever possible, and to not handle any cash if at all feasible.

Combined with the looming prospect of medical martial law and widespread crackdowns on free movement in public, this eerie announcement by both the WHO and the Fed is oddly fitting. Not only does it show just how close we are to a societal collapse, but it also portends prophetic fulfillment and the soon arrival of the Great Tribulation, also known as the Time of Jacob’s Trouble.

As you may recall, Whole Foods Market, also known as “Amazon Foods,” is also introducing its own cashless payment system, as are medical companies that have introduced cashless payment bracelets containing people’s personal medical records and other private information.

Many different elements have been priming the public for the soon coming cashless world, which has never before been as in plain sight as it is now that the Wuhan coronavirus (CoVid-19) is making the rounds on an increasingly global scale.

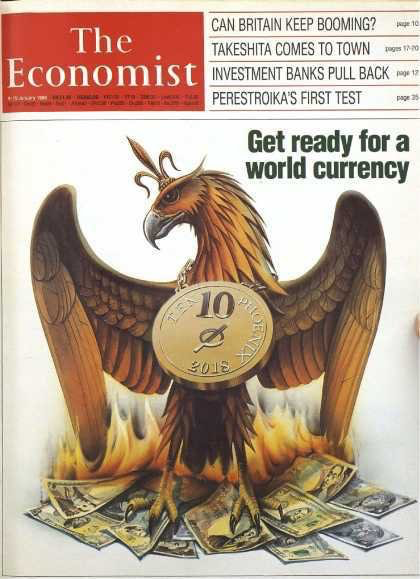

Is the Wuhan coronavirus (CoVid-19) a planned precursor to crash the global system and allow the Phoenix, or Son of Perdition, to eventually rise from the ashes? Will this crisis be used as the perfect catalyst to effectively destroy the financial markets, do away with all cash and currencies, and implement a new digital payment system that will have to be implanted into people’s bodies in the form of a permanent chip?

Put the pieces of the puzzle together for yourself and you can probably answer these questions without us having to provide the answers. Source: NewsTarget

Trump Administration Considering Social Credit Score System to Determine Who Can Buy a Gun, the Anti-Christ System Is in Place and ready to be Implemented THE MARK OF THE BEAST WILL BE AN END-TIMES IDENTIFICATION REQUIRED BY THE ANTICHRIST IN ORDER TO BUY OR SELL. The Trump administration is considering launching a social credit score-style…

Amidst the annual spectacle of the World Economic Forum in Davos, the Bank for International Settlements this week announced that multiple central banks have created a group that will ‘assess potential cases for central bank digital currencies‘

Here is the press release from the BIS in full:

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Sveriges Riksbank and the Swiss National Bank, together with the Bank for International Settlements (BIS), have created a group to share experiences as they assess the potential cases for central bank digital currency (CBDC) in their home jurisdictions.

The group will assess CBDC use cases; economic, functional and technical design choices, including cross-border interoperability; and the sharing of knowledge on emerging technologies. It will closely coordinate with the relevant institutions and forums – in particular, the Financial Stability Board and the Committee on Payments and Market Infrastructures (CPMI).

The group will be co-chaired by Benoît Cœuré, Head of the BIS Innovation Hub, and Jon Cunliffe, Deputy Governor of the Bank of England and Chair of the CPMI. It will include senior representatives of the participating institutions.

As with every other recent development in regards to CBDC’s, the BIS stands at the heart of the issue. The new central bank grouping comes just over six months after the BIS first established an Innovation Hub for central banks (also known as Innovation BIS 2025) with the objective being to ‘foster international collaboration on innovative financial technology within the central banking community‘.

With the agenda to introduce central bank digital currency gathering further momentum, now would be as good a time as any to ask what the global banking elite are seeking to achieve over the short to medium term.

In 2019 I published around a dozen articles on the subject of digital currency, examining the latest speeches from central bankers and the actions they were taking to formulate the foundations for a cashless society. The Innovation BIS 2025 project is an important pillar to the aspirations of the financial elite. By 2025 they are targeting the completion of reformed payment systems in the UK, the U.S and beyond, systems that will possess the capability to interface directly with Fintech firms that specialize in blockchain and distributed ledger technology (DLT). Both blockchain and DLT would be essential for the roll-out of a fully-fledged CBDC network.

During a speech at the Central Bank of Ireland in March 2019, BIS General Manager Agustin Carstens stated plainly what a CBDC future would look like:

Like cash, a CBDC could and would be available 24/7, 365 days a year. At first glance, not much changes for someone, say, stopping off at the supermarket on the way home from work. He or she would no longer have the option of paying cash. All purchases would be electronic.

To avoid confusion, there are two variants of CBDC that are regularly discussed by central bank officials. The first is a wholesale CBDC, which would be used to facilitate payments exclusively between financial sector firms. The second option, a retail CBDC, would be for use by the general public.

To quote Carstens from the same speech he made in Ireland:

A CBDC would allow ordinary people and businesses to make payments electronically using money issued by the central bank. Or they could deposit money directly in the central bank, and use debit cards issued by the central bank itself.

This would be a significant departure from the traditional model of commercial banks digitizing the money held in people’s bank accounts. To way up the likelihood of this scenario, let’s examine what the International Monetary Fund have been saying.

Former Managing Director Christine Lagarde, who is now President of the European Central Bank, addressed the Singapore Fintech Festival in November 2018 and hinted at how the future composition of a CBDC could look:

If digital currencies are sufficiently similar to commercial bank deposits— then why hold a bank account at all?

What if, instead, central banks entered a partnership with the private sector—banks and other financial institutions—and said: you interface with the customer, you store their wealth, you offer interest, advice, loans. But when it comes time to transact, we take over.

Banks and other financial firms, including startups, could manage the digital currency. Much like banks which currently distribute cash.

In this reality, central banks would, according to Lagarde, ‘retain a sure footing in payments‘. By extension, they would also retain autonomy over an all digital financial system.

The IMF expanded on Lagarde’s speech in December 2019 with the publication of an article called, ‘Central Bank Digital Currencies: 4 Questions and Answers‘. Co-written by Tobias Adrian, the Financial Counsellor and Director of the IMF’s Monetary and Capital Markets Department, it asserts that the IMF is now gradually helping countries ‘develop policies‘ as they ‘consider CBDC options and seek advice.’

One of those options is a public-private partnership, which IMF staffed have termed as a ‘synthetic CBDC‘. In the summer of 2019 Mark Carney first raised the prospect of a ‘Synthetic Hegemonic Currency‘ that could be provided by the public sector ‘through a network of central bank digital currencies‘. This would ultimately be at the expense of the world reserve status of the dollar.

The synthetic CBDC model as envisioned by the IMF would see private sector firms like JP Morgan and Barclays issuing digital coins to the general population. Banks would continue ‘innovating and interfacing with customers‘, whilst central banks would ‘provide trust to the system by requiring that coins be fully backed with central bank reserves and by supervising the coin issuers.’ This is worth keeping in mind because as the article confirms, such a set up would ‘preserve the comparative advantages of each participant.’ In other words, global financial institutions and the central banks operating beneath them would work hand in hand with Fintech developers rather than be in competition, creating a state / private lock-in that every citizen would be bound by due to the abolition of cash.

The coins the IMF refers to are known as ‘Stablecoins‘, which central bankers routinely discussed throughout 2019. Stablecoins are regarded as a form of cryptocurrency, and differ from the likes of Bitcoin in that issuers of the coins would back them using a basket of established fiat currencies. The theory is that this would give the stability of the coin in terms of its valuation. Stablecoins would be all digital with blockchain and distributed ledger technology central to their make up, meaning payments would be instantaneous across borders.

A few days after the IMF’s article, Lael Brainard of the Federal Reserve addressed an event held in Frankfurt, Germany in honor of Benoit Coeure’s departure from the European Central Bank (the same Benoit Coeure who has now begun his new role heading up the Innovation Hub at the BIS).

This was an important speech because between the lines Brainard set the scene for how central banks could take advantage of the rise in stablecoins. She talked of how the emergence of crypto technology has raised ‘important questions for central banks‘, and that the ‘prospect of global stablecoin payment systems has intensified the interest in central bank digital currencies.’

Facebook’s Libra project is cited by central banks as the bellwether of stablecoins. Whilst Libra has yet to launch, implementation would give it the title of a global stablecoin used throughout multiple different jurisdictions. For Brainard and her colleagues, this brings into question the level of regulation and safeguards that they deem necessary for stablecoins to be rolled out worldwide. Without them, Brainard warned, ‘stablecoin networks at global scale may put consumers at risk‘ as well as the financial system as a whole.

There are also questions related to the implications of a widely used stablecoin for financial stability. If not managed effectively, liquidity, credit, market, or operational risks, alone or in combination, could trigger a loss of confidence and run-like behaviour.

Chief amongst the risks raised is money laundering and the financing of terrorism, and it is here where the distinction between a permission and permissionless stablecoin network becomes apparent. Central bankers openly advocate for a permission network where access must be granted by participants. A permissionless network, according to Brainard, ‘may be more vulnerable to money laundering and terrorist financing.’

One solution mooted by Brainard would be for coordinated regulatory action rather than individual nations determining how stablecoins would be allowed to function. In Brainard’s words, ‘any global payments network should be expected to meet a high threshold of legal and regulatory safeguards before launching operations.’

Elites have been fashioning for decades the narrative that global problems are too large and complex in scale to be remedied at the national level. Their argument has been that more centralization of powers and the diminishment of the nation-state is required to bring about order out of chaos. The seeming regulatory vacuum surrounding stablecoins has given central banks the platform to gradually begin cementing central bank digital currency as a safer alternative, primarily because they would be a ‘direct liability of the central bank.’

As the debate continues around digital currency, the Federal Reserve is quietly progressing with plans to introduce a new payment system called ‘FedNow‘. This will be a platform where users would be able to ‘send and receive payments immediately and securely 24 hours a day, 365 days a year.’

The biggest selling point of digital currency is the convenience factor of national and cross border payments being settled and available without delay. I suspect this is where the banking elite wants people to focus their attention, as opposed to how a digital currency network that incorporates central banks and selected private sector players would result in the end of tangible assets.

If you believe what central bankers are saying, then the concept of CBDC’s remain at the investigative stage. Sweden continues to lead the way with the development of an e-krona. The Riksbank has now procured a technology supplier to begin an e-krona test pilot, with the leading objective being to ‘broaden the bank’s understanding of the technological possibilities for the e-krona.’

With the Riksbank being part of the new central bank group working through the BIS, and the IMF admitting that they are now assisting countries in devising policies around digital currency, we are witnessing just how closely they are all collaborating with one another.

One question is whether stable coins will be used as a stalking horse for CBDC’s, taking them beyond a mere concept. Financial instability has always been an opportunity for the global elite. Stablecoins without sufficient regulatory oversight creates an opening for central banks to step in further down the line.

Something to ponder also is how faith could be lost with future stablecoin providers. BIS General Manager Agustin Carstens has said before that trust can be compromised in four particular ways – currency devaluations, hyperinflation, wide-scale payment system disruptions, and bank defaults. Naturally, Carstens has positioned central banks as the institutions that can rectify such conflict, even though it has been proven that throughout history it is their policies that have created economic instability leading to collapse.

In relation to what Carstens said about compromising trust, three months prior to the EU referendum Bank of England official Ben Broadbent made a very telling comment in a speech appropriately titled, ‘Central banks and digital currencies‘, about the necessity for currency degradation before the public demand a solution to the traditional monetary model.

Degrade a currency sufficiently, via hyperinflation and collapse of the banking system, and people will eventually look for alternatives. But that’s generally the sort of thing that has to happen. Almost always, these currency substitutions occur only once the existing currency has become deeply compromised. Even then, the thing people naturally reach for is an existing, trusted currency – often the US dollar – rather than some entirely new unit of account.

When currency substitution has occurred naturally it’s almost always done so only after the incumbent currency has been debauched by hyperinflation.

I have warned extensively over the past couple of years of the risk of a global trade conflict triggering higher inflation, the devaluation of currencies such as sterling and the raising of interest rates. It is what would occur afterward that is of more concern. Would people look to central banks as the saviors in a crisis scenario, giving them a license to digitize all assets through a network of CBDC’s?

As ever, central banks will require sustained geopolitical conflict to shape the future design of the financial system. They are already headlong in devising that very system through the reformation of global payment systems. But with distractions in the shape Brexit and Donald Trump’s presidency still dominating the discourse, potentially up to 2025, how many are even aware of what the central banks are planning?

The Bible Prophesies That a Peace Agreement Will Be Signed Between the Palestinians and the Israelis, Which Will Start the Final Seven Years to Armageddon.

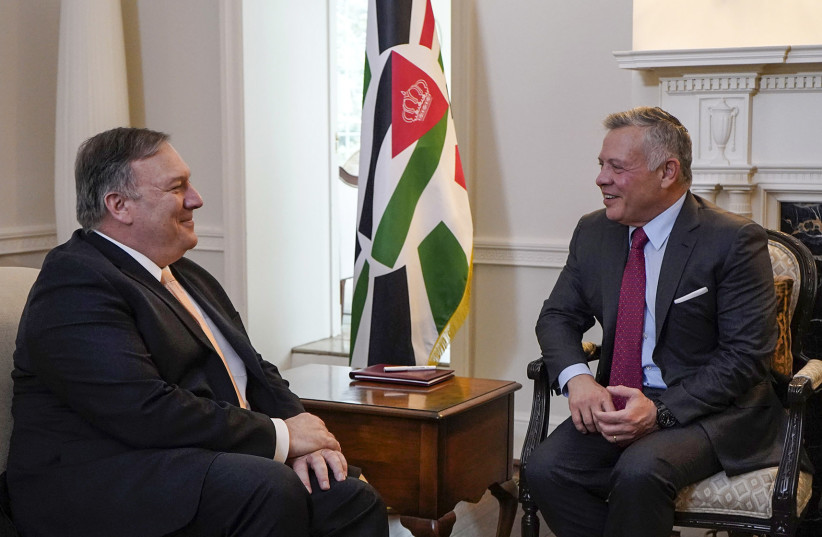

Jordan’s King Abdullah, President Donald Trump’s Deal of the Century.

A handout picture released by the Jordanian Royal Palace on March 11, 2019, shows Jordanian King Abdullah II (R) meeting with US Secretary of State Mike Pompeo in Washington, DC(photo credit: YOUSEF ALLAN / JORDANIAN ROYAL PALACE / AFP)

Jordan’s King Abdullah warned that Israeli annexation plans and its absence of a government were harming his country’s relationship with the Jewish state, as he spoke with France24 about the possibility that US President Donald Trump’s peace plan would soon be unveiled.“We keep hearing that sometime soon the plan would be presented,” Abdullah told the French television station on the eve of a visit this week to Brussels, Strasbourg, and Paris.

The king plans to hold talks with the Europeans on Iran, Iraq, ISIS, Syria, and the Israeli-Palestinian conflict. While in Strasbourg, Abdullah will deliver a special address to the European Parliament on Wednesday. Jordan and the European Union both hold that the resolution to the Israeli-Palestinian conflict is a two-state solution based on the pre-1967 lines, with East Jerusalem as the capital of a Palestinian state.

The Trump administration has hinted that its plan is unlikely to include this scenario and has been quiet with regard to Prime Minister Benjamin Netanyahu’s election pledges to annex West Bank settlements, beginning with the Jordan Valley. Both the EU and Jordan have opposed that move, with King Abdullah warning that it would harm ties with Israel, which have already been weakened by the prolonged election cycle in Israel which has lasted for over a year.“There is certain rhetoric [annexation talk] coming out of Israel because of the electoral politics, which is creating tremendous concern to all of us in the region. They [Israel] are moving way off into a direction that is completely uncharted territory for all of us,” King Abdullah said. The king added that the annexation pledges “can only create more instability and miscommunication.” It comes as the dialogue between Israel and Jordan has been “on pause” for two years, King Abdullah said. During that time, “there has been no bilateral communications or movement.”

Israel and Jordan have had diplomatic ties since the two countries signed a peace deal in 1994, but the friendship has frayed in the last few years. King Abdullah assured France24 that ties between his country and Israel were “important.” But the annexation talk, he said, “creates a lot of doubt in many of us on where are certain Israeli politicians going” and could have a negative impact on the two countries, he said. Jordan is waiting to see the result of the election so that it can asses how best to move forward on the Israeli-Jordanian tract, King Abdullah said adding that hoped a new Israeli government was formed sooner rather than later. Israeli-Palestinian negotiations, which have been frozen since 2014, must be resumed, King Abdullah said.”Jordan is strategically committed to the peace between Jordan and Israel, that is a major element of stability in the region,” he said. King Abdullah added that he wanted to be hopeful about the Trump administration’s plan, and has spoken with Trump about it “numerous” times.” The US president “understands what is needed to bring Israelis and Palestinians together,” King Abdullah said.“We are waiting for the plan to be unveiled by the [Trump] team.

That has been a gray area for all of us, because unless we know what the plan is,” it is difficult to know what role Jordan and the regional countries can play, he said. Once the plan is unveiled Jordan will do its best to take a positive stance, King Abdullah said. “Our job then is to look at the glass as half-full” and to think of “how do we build on the plan in such a way that we bring the Israelis and Palestinians together.”It is difficult for us to make decisions on the plan when we really do not know what it is. That is not a problem just for Jordan but for our European friends, and we will be discussing this in Europe this week,” King Abdullah said.

The Bible prophesies that a peace agreement will be signed between the Palestinians and the Israelis, which will start the final seven years to Armageddon.

The White House believes a divided Palestinian Authority cannot rule as one nation after a peace deal that creates two States inside the boundaries of Israel. The PA and Hamas must come to a unifying agreement in order for any peace treaty to succeed. In other words, Hamas must join with the PA in order for Israel to feel secure enough about the Palestinians being willing to live in peace with the Jewish State.

To that end, the Trump administration officials worked the phones for weeks to bring Israeli and Arab diplomats around the same table at the White House and finally succeeded in doing so for the first time on Tuesday.

Senior administration officials said several parties to the US conference, which focused on the dire and pressing humanitarian plight facing Palestinians in the Gaza Strip, had expressed that “they could not be in the same room as each other.”

And yet, one senior official said, “We had discussions with them, and everybody realized the importance of being in the room”.

The discussion, which took six hours, brought national security officials from Israel, Saudi Arabia, Qatar, the United Arab Emirates, Oman, and Bahrain together for an exceptional diplomatic moment – the possible start of a regional dialogue over Israeli-Palestinian peace, ahead of the publication of a peace plan by the Trump administration meant to comprehensively end claims to the conflict.

This grouping of nations is particularly interesting for Bible prophecy. In previous weeks, I have mentioned that these nations have different fates. Israel and Saudi Arabia will be attacked and conquered by the King of the North, Iran. Qatar, the United Arab Emirates, Oman, and Bahrain, along with Kuwait who was not in this meeting, will side with Turkey when Ankara tries to take the Shi’ite Caliphate from Iran in the future. This will be the reason for Iran and Russia going global militarily.

They perverted justice among themselves (v. 7): “You turn judgment to wormwood, that is, you make your administrations of justice bitter and nauseous, and highly displeasing both to God and man.’’ That fruit has become a weed, a weed in the garden; as nothing is more venerable, nothing more valuable, than justice duly administered, so nothing is more hurtful, nothing more abominable, than designedly doing wrong under color and pretense of doing right. Corruptio optimi est pessima —The best, when corrupted, becomes the worst.